Different businesses need different features. Features can be optionally installed and each feature has its own settings. We have listed some of our more common features below.

Business Object Management Services

These features allow you to fine tune the management of the business objects you have defined.

Input & Display

Configure the input forms for creating your business objects such as customer and account. You can choose the order of fields, default values, grouping, calculations and validations. You can also define how business objects are displayed, including views linked to user roles.

Search & List

Choose which properties of your business objects are indexed in our search engine and define how business objects are listed when searched.

Import & Export

Import and export information to and from CreditPlus. Import is useful if you have existing business objects that you need to import.

Audit

Record the date, time and user as well as before and after snapshots of business object changes.

Extension Services

CreditPlus has a library of actions and functions which connect to events and workflows. Actions and functions have parameters which bind to the business objects you have defined, or link to other functions. This offers massive flexibility. If you calculate interest or fees, you could use the rate from a loan, customer, dealer, or any other business object you have defined. CreditPlus manages these scenarios with ease and we can add new actions and functions easily.

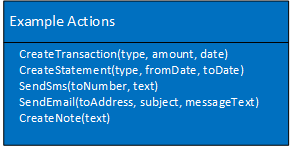

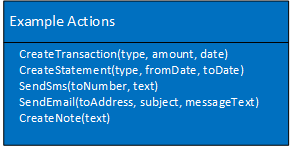

Actions

Actions are individual items of functionality. You can link system and user events to actions. When the event occurs, we process the actions. The opening of an account or the reaching of a certain age of debt could trigger actions such as send letter, send sms, send statement or change interest rate.

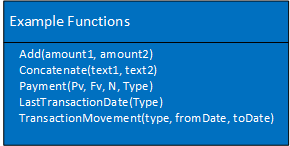

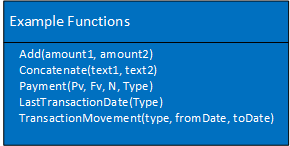

Functions

Like those you find in Excel, our functions are used as parameters to actions and offer calculations, default values and validation when creating and editing business objects

Workflow Services

Workflows allow you to package a series of actions into a single process. Consider a business process where at a certain number of days an account is in arrears you wish to send a letter, apply a fee and increase the interest rate. Instead of a user undertaking multiple steps, we define this type of process as a workflow.

On Demand workflows

Users may action on-demand workflows against a business object.

Collection Workflows

Collection workflows allow you to process a workflow against a collection of business objects. This collection could consist of all business objects of a certain type (i.e. customers) or be based on a query (i.e. customers with a balance greater than x).

Workflow Approvals

Optionally subject workflows to an approval process to control sensitive operations.

Workflow Imports

Import workflows from XML or a spreadsheet for example to import transactions from an external source.

Transactions

Transactions occur against business objects over time. They consist of money transfers (receipt, payments), fees, commissions or any other user-defined transaction type. You define the balances they update. Transactions are input, imported, created a result of actions, or calculated and scheduled. Our value dating facility ensures that if values used in the calculation of transactions change we generate adjustment transactions.

Accounting

Configure how transaction types link to your general ledger accounts. We post summary journal entries to your general ledger with reconciliation reports detailing the transactions that make up each journal.

Payments

Direct credits and debits are available on a scheduled or on demand basis via a variety of payment methods and gateways.

Cashier

Define and manage cashier points and the allocation of receipts to accounts.

Checklists

Define standard or ad-hoc requirements and mark them complete using checklists. You can optionally trigger actions on completion of a checklist item.

Compliance

Unlike validation which prevents you from entering certain data, the compliance module allows you to define data input policies and analyse the reasons for non compliance.

Scoring

Our simple scoring module allows you to use conditions to calculate a score for a business object such as a customer or application. The result score is compared against defined ranges and actions triggered

Credit Reporting

The credit reporting extension point allows you to obtain, store and analyse credit reports from various credit agencies.

Authentication

CreditPlus uses Microsoft Active directory to authenticate users enabling single sign on. Active Directory provides you with first class user and authorisation management.

Authorisation

Authenticated users are subject to the authorisation rules defined for access to functions and features

Documents

Create professional quality documents templates such as customer letters and legal agreements using Microsoft word. Store and distribute Documents on a scheduled or on demand basis by merging information from the content management.

Statements

The statement module in interacts with our document system allowing you a wide range of statements either on a scheduled or ad-hoc basis.

Email

Distribute documents and send text messages by transactional email.

Sms

We integrate with Sms gateways to allow you to send sms messages on a scheduled, event driven or ad-hoc basis.

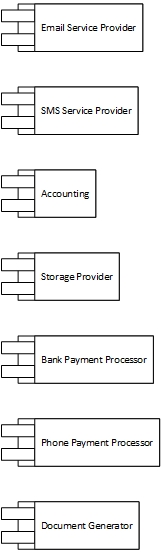

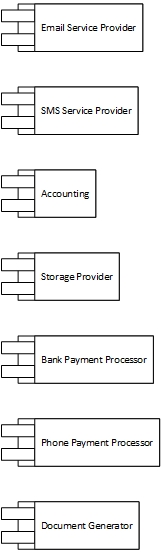

Extension points

Our extension points allow for easy integration third party systems.